99 Pledges Reviews You Can't Ignore

99 Pledges Reviews: A Comprehensive Guide

99 Pledges is an online platform that connects borrowers with lenders for personal loans. The company has been in business since 2009 and has funded over $2 billion in loans. 99 Pledges has a wide network of lenders, which allows them to offer competitive interest rates and loan terms. The company also has a simple and easy-to-use online application process.

99 Pledges has received positive reviews from borrowers. The company has a 4.8-star rating on Trustpilot, and 95% of borrowers would recommend 99 Pledges to a friend. Borrowers praise the company for its competitive interest rates, loan terms, and customer service.

99 Pledges is a good option for borrowers who need a personal loan. The company has a wide network of lenders, which allows them to offer competitive interest rates and loan terms. The company also has a simple and easy-to-use online application process.

99 Pledges Reviews

99 Pledges is an online platform that connects borrowers with lenders for personal loans. The company has been in business since 2009 and has funded over $2 billion in loans. 99 Pledges has a wide network of lenders, which allows them to offer competitive interest rates and loan terms. The company also has a simple and easy-to-use online application process.

- Competitive interest rates: 99 Pledges has a wide network of lenders, which allows them to offer competitive interest rates on personal loans.

- Flexible loan terms: 99 Pledges offers flexible loan terms, so borrowers can choose a loan that fits their budget and needs.

- Easy online application: The 99 Pledges online application process is simple and easy to use.

- Fast funding: 99 Pledges can fund loans quickly, so borrowers can get the money they need fast.

- Excellent customer service: 99 Pledges has a team of dedicated customer service representatives who are available to help borrowers with any questions or concerns.

99 Pledges is a good option for borrowers who need a personal loan. The company has a wide network of lenders, which allows them to offer competitive interest rates and loan terms. The company also has a simple and easy-to-use online application process and a team of dedicated customer service representatives who are available to help borrowers with any questions or concerns.

Competitive interest rates

One of the most important factors to consider when choosing a personal loan is the interest rate. A lower interest rate means you'll pay less money over the life of the loan. 99 Pledges has a wide network of lenders, which allows them to offer competitive interest rates on personal loans. This means that you're more likely to get a good deal on your loan if you go through 99 Pledges.

In addition to offering competitive interest rates, 99 Pledges also offers flexible loan terms and a simple online application process. This makes it easy to get the money you need quickly and easily.

If you're considering getting a personal loan, it's important to shop around and compare interest rates from different lenders. 99 Pledges is a good option to consider, as they offer competitive interest rates and flexible loan terms.

Flexible loan terms

In addition to offering competitive interest rates, 99 Pledges also offers flexible loan terms. This means that borrowers can choose a loan that fits their budget and needs. For example, borrowers can choose a loan with a shorter or longer term, and they can also choose a loan with a fixed or variable interest rate. This flexibility is important because it allows borrowers to find a loan that meets their specific financial situation.

- Loan amounts: 99 Pledges offers personal loans in amounts ranging from $1,000 to $50,000.

- Loan terms: 99 Pledges offers loan terms ranging from 12 to 60 months.

- Interest rates: 99 Pledges offers fixed and variable interest rates. Fixed interest rates start at 7.99%, and variable interest rates start at 5.99%.

- Fees: 99 Pledges charges an origination fee of 1% to 5% of the loan amount.

The flexibility of 99 Pledges' loan terms is one of the things that makes the company a good option for borrowers. Borrowers can find a loan that meets their specific financial situation and needs.

Easy online application

The ease of the 99 Pledges online application process is a major factor in the company's positive reviews. Borrowers appreciate the ability to apply for a loan quickly and easily, without having to go through a lengthy and complicated process. This is especially important for borrowers who are in need of a loan quickly, such as for an emergency expense.

The 99 Pledges online application process is designed to be user-friendly and efficient. Borrowers can apply for a loan in just a few minutes, and they can do so from any device with an internet connection. The application process is also secure, so borrowers can be confident that their personal information is safe.

The ease of the 99 Pledges online application process is a key reason for the company's positive reviews. Borrowers appreciate the ability to apply for a loan quickly and easily, without having to go through a lengthy and complicated process.

Fast funding

Fast funding is one of the key benefits of using 99 Pledges to get a personal loan. Borrowers appreciate being able to get the money they need quickly, without having to wait weeks or even months for approval. This is especially important for borrowers who are in need of a loan for an emergency expense, such as a medical bill or car repair.

- Quick and easy application process: The 99 Pledges online application process is quick and easy to use. Borrowers can apply for a loan in just a few minutes, and they can do so from any device with an internet connection.

- Fast approval: Once a borrower submits their application, 99 Pledges will review it quickly and make a decision. In most cases, borrowers will receive a decision within 24 hours.

- Fast funding: Once a loan is approved, 99 Pledges will fund the loan quickly. In most cases, borrowers will receive the money they need within a few days.

The fast funding process of 99 Pledges is a major factor in the company's positive reviews. Borrowers appreciate being able to get the money they need quickly and easily, without having to go through a lengthy and complicated process.

Excellent customer service

Excellent customer service is one of the key factors that contribute to positive 99 Pledges reviews. Borrowers appreciate being able to speak to a real person who can help them with their questions or concerns. This is especially important for borrowers who are new to the personal loan process or who have complex financial situations.

- Responsiveness: 99 Pledges customer service representatives are responsive and quick to answer questions. Borrowers can expect to receive a response to their email or phone call within 24 hours.

- Knowledge: 99 Pledges customer service representatives are knowledgeable about the personal loan process and can answer any questions that borrowers may have. They can also help borrowers find the right loan for their needs.

- Courtesy: 99 Pledges customer service representatives are courteous and professional. They treat borrowers with respect and understanding.

The excellent customer service of 99 Pledges is a major factor in the company's positive reviews. Borrowers appreciate being able to speak to a real person who can help them with their questions or concerns. This makes the personal loan process easier and less stressful.

99 Pledges Reviews FAQs

This section addresses common questions and concerns raised in 99 Pledges reviews.

Question 1: Are the interest rates offered by 99 Pledges competitive?

Yes, 99 Pledges offers competitive interest rates on personal loans. The company has a wide network of lenders, which allows them to offer lower interest rates than many other lenders.

Question 2: Are there any hidden fees associated with 99 Pledges loans?

No, there are no hidden fees associated with 99 Pledges loans. The company charges a one-time origination fee, which is typically 1% to 5% of the loan amount. This fee is clearly disclosed to borrowers before they apply for a loan.

Question 3: Is the 99 Pledges online application process secure?

Yes, the 99 Pledges online application process is secure. The company uses SSL encryption to protect borrower data, and all personal information is stored on secure servers.

Question 4: How quickly can I get funded if I apply for a loan through 99 Pledges?

99 Pledges offers fast funding. Once a loan is approved, borrowers can typically receive the money within a few days.

Question 5: What is the customer service like at 99 Pledges?

99 Pledges has excellent customer service. The company has a team of dedicated customer service representatives who are available to help borrowers with any questions or concerns.

Question 6: What are the eligibility requirements for a 99 Pledges loan?

To be eligible for a 99 Pledges loan, borrowers must be at least 18 years old, have a valid Social Security number, and have a regular source of income.

These are just a few of the most common questions and concerns raised in 99 Pledges reviews. For more information, please visit the 99 Pledges website.

Tips from "99 Pledges Reviews"

99 Pledges is an online platform that connects borrowers with lenders for personal loans. The company has been in business since 2009 and has funded over $2 billion in loans. 99 Pledges has a wide network of lenders, which allows them to offer competitive interest rates and loan terms. The company also has a simple and easy-to-use online application process.

Here are a few tips from 99 Pledges reviews:

Tip 1: Compare interest rates from multiple lenders. 99 Pledges has a wide network of lenders, which allows them to offer competitive interest rates on personal loans. However, it's still important to compare interest rates from multiple lenders to make sure you're getting the best deal.

Tip 2: Choose a loan term that fits your budget. 99 Pledges offers flexible loan terms, so you can choose a loan that fits your budget and needs. For example, you can choose a loan with a shorter or longer term, and you can also choose a loan with a fixed or variable interest rate.

Tip 3: Make sure you understand the fees associated with your loan. 99 Pledges charges an origination fee of 1% to 5% of the loan amount. It's important to make sure you understand this fee before you apply for a loan.

Tip 4: Read the loan agreement carefully before you sign it. The loan agreement will contain important information about your loan, such as the interest rate, loan term, and repayment schedule. It's important to read the loan agreement carefully before you sign it so that you understand all of the terms and conditions.

Tip 5: Make your payments on time. Making your payments on time is important for building credit and avoiding late fees.

By following these tips, you can increase your chances of getting a good deal on a personal loan from 99 Pledges.

Key takeaways:

- Compare interest rates from multiple lenders.

- Choose a loan term that fits your budget.

- Make sure you understand the fees associated with your loan.

- Read the loan agreement carefully before you sign it.

- Make your payments on time.

By following these tips, you can increase your chances of getting a good deal on a personal loan.

Conclusion

99 Pledges is a reputable online platform that connects borrowers with lenders for personal loans. The company has a wide network of lenders, which allows them to offer competitive interest rates and loan terms. The company also has a simple and easy-to-use online application process, and a team of dedicated customer service representatives who are available to help borrowers with any questions or concerns.

Overall, 99 Pledges is a good option for borrowers who need a personal loan. The company offers competitive interest rates, flexible loan terms, and a simple online application process. Borrowers can also be confident that they will receive excellent customer service from 99 Pledges.

Unleash Canine Enrichment: Discover The Ultimate Lick Mat Alternatives

Unveiling The Enigmatic World Of Hard Jewelry Septum: Uncover Surprises

Unlock Culinary Secrets: Discover The Tangy World Of Sour Pickle Kits

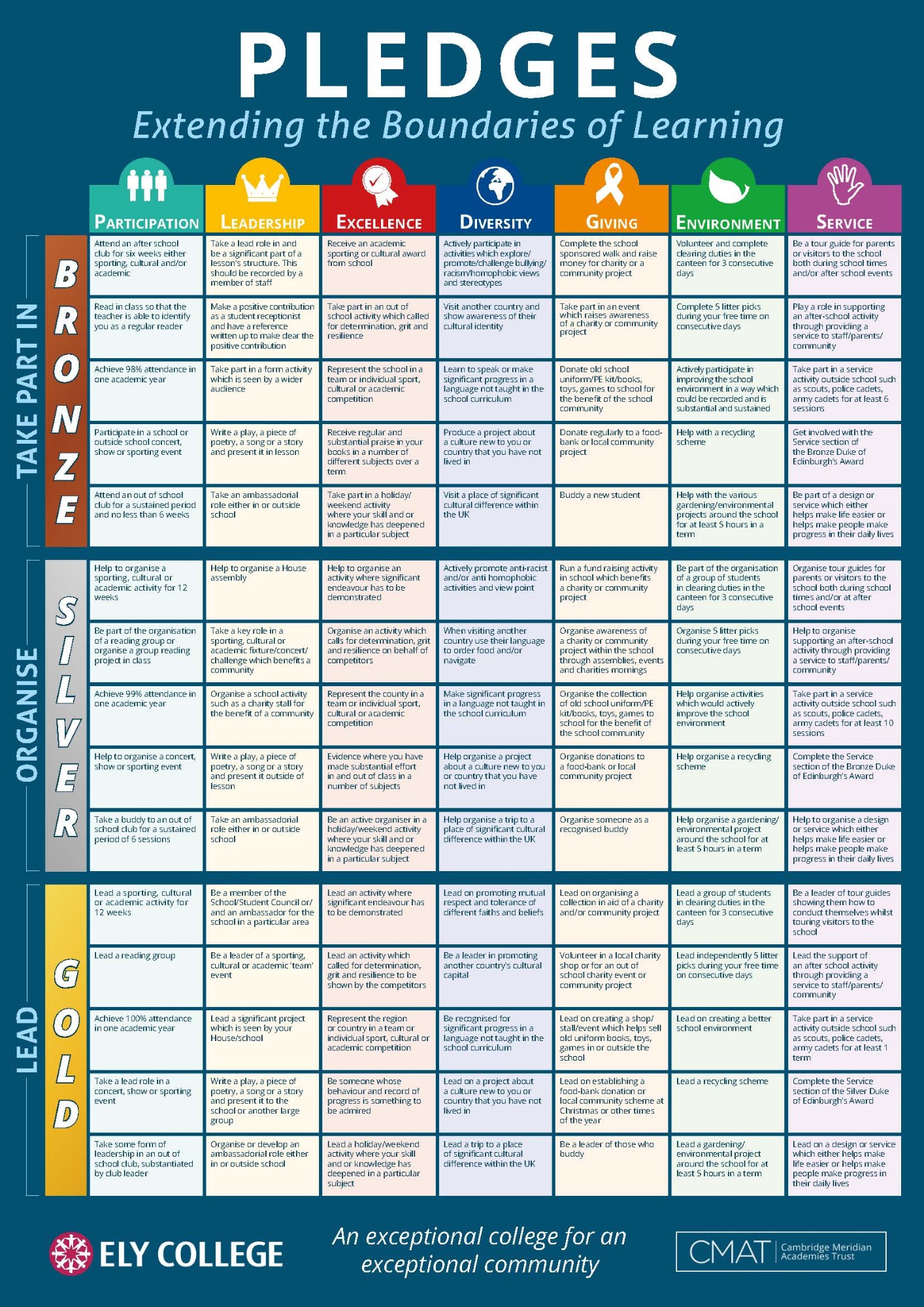

PLEDGES Sharnbrook Academy

Celebrating 1,000 Pledges! Pledge 1

ncG1vNJzZmirn6i8ra3Lmmlnq2NjwrR51p6qrWViY66urdmopZqvo2OwsLmOcnBmqJyasaix0mapnq6ZmsS0esetpKU%3D